Paul B Insurance Can Be Fun For Anyone

Wiki Article

The Buzz on Paul B Insurance

Table of ContentsPaul B Insurance Can Be Fun For EveryoneThe Facts About Paul B Insurance UncoveredWhat Does Paul B Insurance Mean?10 Easy Facts About Paul B Insurance ExplainedThe 4-Minute Rule for Paul B Insurance

The thought is that the money paid in insurance claims in time will be much less than the overall premiums gathered. You may really feel like you're throwing money out the window if you never ever sue, however having piece of mind that you're covered on the occasion that you do suffer a considerable loss, can be worth its weight in gold.Envision you pay $500 a year to insure your $200,000 residence. You have ten years of making payments, as well as you've made no insurance claims. That comes out to $500 times one decade. This implies you have actually paid $5,000 for home insurance coverage. You start to question why you are paying a lot for nothing.

Because insurance coverage is based upon spreading the danger amongst many individuals, it is the pooled cash of all people spending for it that permits the company to develop properties and cover insurance claims when they take place. Insurance is an organization. Although it would behave for the companies to just leave rates at the very same degree constantly, the truth is that they need to make enough money to cover all the prospective cases their insurance policy holders might make.

Some Known Details About Paul B Insurance

exactly how much they entered premiums, they must revise their rates to make money. Underwriting changes and also price rises or declines are based upon outcomes the insurer had in previous years. Relying on what firm you buy it from, you may be handling a captive representative. They offer insurance coverage from only one firm.The frontline individuals you take care of when you purchase your insurance policy are the agents and also brokers who stand for the insurance coverage company. They will certainly discuss the kind of items they have. The captive representative is a representative of just one insurance provider. They an accustomed to that business's items or offerings, but can not talk in the direction of other firms' policies, prices, or item offerings.

Paul B Insurance Can Be Fun For Everyone

The insurance policy you require differs based on where you are at in your life, what kind of properties you have, and also go to this website what your long-term objectives as well as tasks are. That's why it is crucial to make the effort to discuss what you want out of your plan with your representative.If you secure a lending to buy a vehicle, and after Related Site that something takes place to the cars and truck, void insurance will certainly settle any portion of your lending that standard automobile insurance policy does not cover. Some lenders need their debtors to carry void insurance coverage.

The Facts About Paul B Insurance Revealed

Life insurance policy covers the life of the guaranteed person. The insurance policy holder, that can be a different individual or entity from the guaranteed, pays premiums to an insurer. In return, the insurance firm pays out a sum of cash to the recipients noted on the plan. Term life insurance covers you for a time period selected at acquisition, such as 10, 20 or 30 years.Term life is prominent since it supplies huge payouts at a lower cost than long-term life. There are some variations of common term life insurance coverage plans.

Long-term life insurance plans construct money value as they age. The cash money value of whole life insurance policy plans grows at a set price, while the cash worth within universal policies can rise and fall.

All About Paul B Insurance

$500,000 of entire life coverage for a healthy and balanced 30-year-old female expenses around $4,015 each year, on average. That exact same level of protection visite site with a 20-year term life plan would cost a standard of about $188 every year, according to Quotacy, a broker agent company.Those investments come with more danger. Variable life is another long-term life insurance policy option. It seems a great deal like variable global life yet is really various. It's an alternative to whole life with a set payment. Insurance holders can use investment subaccounts to grow the cash worth of the plan.

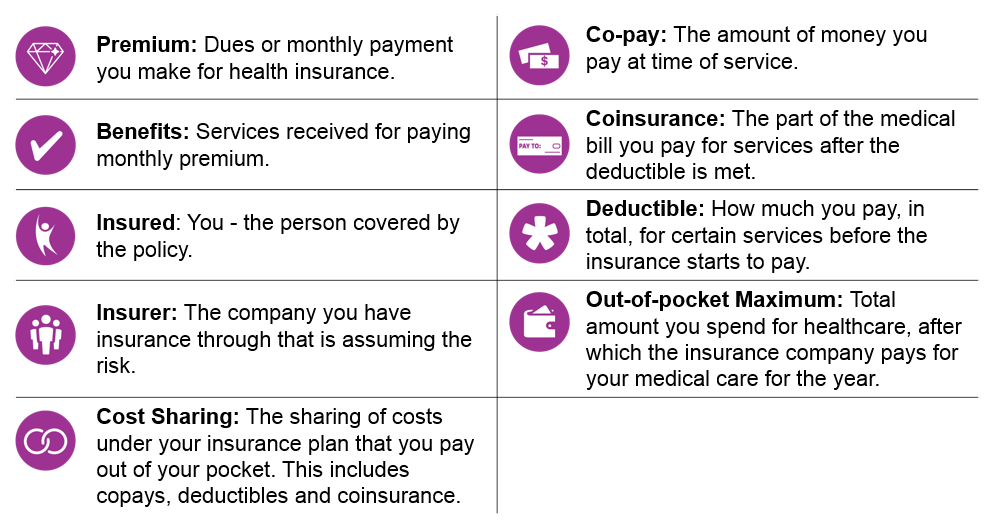

Right here are some life insurance policy fundamentals to assist you better understand how coverage functions. Costs are the settlements you make to the insurance provider. For term life policies, these cover the cost of your insurance and also management expenses. With an irreversible plan, you'll likewise be able to pay money right into a cash-value account.

Report this wiki page